Programming note: After a few weeks of feedback, I’ve decided to call this column “GTM Analyst” moving forward. Thanks for subscribing!

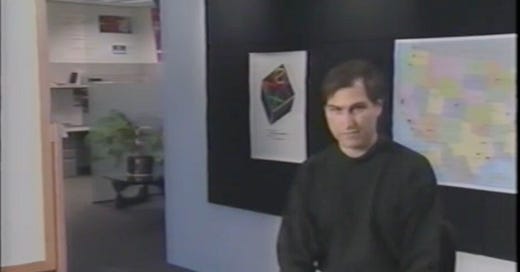

In 1991, Steve Jobs sat down in front of a camera and recorded the first of a few “chalk talks” for NeXT, his computer company.

It was a pivotal moment for the firm. They had spent the last three years searching for product-market fit after launching the NeXT Computer in 1988, followed by the NeXT Cube and NeXTstation in 1990.

The executive team of the company spent months agonizing over the data, talking to customers, and talking to internal team members. Then, the revelation hit.

What followed is almost 19 minutes of some of the purest business strategy I’ve ever seen committed to video, delivered in the classic Jobs fashion: no jargon, a powerful and simple-to-follow story, and a lot of specificity.

Today, I’m breaking down this masterclass in 10 segments. The full video is at the end if you’d like to watch it all the way through.

1. What is GTM strategy?

Steve starts the video by posing three core questions that form the core of any go-to-market (GTM) strategy:

Who is our target customer?

Why are they selecting our product over our competition’s?

What distribution channels are we going to use to reach those customers?

Question #2 is particularly striking. It’s one question more companies, particularly those who have a good customer base, need to be asking. It’s no longer “why should they buy our product in the first place?” That’s the question of a startup. Now it’s, why us vs. our competitors?

Steve was competing against Sun Microsystems as well as the dominant PC and Mac markets with his computer startup. Talk about competition!

Answering this question is particularly important because we are all now living in a more competitive era. More competition for the same money, mindshare, and priorities. A good GTM strategy in B2B is no longer “spend as much as possible to try and acquire as many customers as possible.” That worked for a time. It no longer is profitable. Now, we have to compete against our direct competitors, “good enough” solutions, and the status quo to grow.

2. Sources of Data

He references three kinds of data that he’s using to answer these questions (and references these throughout the video).

First, customer interviews. The company has been out in the field talking to customers. What do they like about the product? What don’t they like about the product? Why did they buy NeXT?

Second, internal interviews and feedback. He’s gathered input from product and sales teams. What are they seeing in the field? What are they hearing from customers? What are common objections they hear in a sales process?

Third, external data sources. He doesn’t explicitly call out a market research firm they hired but does reference quantitative sources he has that a 3rd party firm very likely provided.

I would guess if you polled 100 B2B companies, most use external data sources when creating a GTM strategy, some use customer interviews, and only a few use internal sources. Speaking from experience, I think too few companies have the expertise to structure good internal interviews and filter the information into valuable nuggets for the overarching GTM strategy.

They get distracted by one salesperson’s opinion or one marketing executive’s perspective, instead of filtering that data through a methodology to arrive at valuable conclusions. (Plus, there’s also the politics of who gets listened to – something Steve was… famous for not caring too much about)

3. Market Map and Competition

He then builds a market map. It’s very simple: the big workstation market they had been pursuing filled with different competitors, but dominated by Sun Microsystems. Then, he identifies the other competitive market (PCs/Macs). In spirit, they’re closer to the PCs/Macs thanks to their user interface design.

The power of this exercise is in its simplicity. Mapping a market, the competitors, and the various segments should be simple. He doesn’t obsess over their feature sets yet. He’s just trying to understand: what does the market look like? And where does NeXT fit in?

4. Compelling Positioning as a Function of Segmentation

This is a moment I love. He then asks, after mapping the market:

In essence, are we an easier to use workstation or are we a more powerful PC?

Positioning (as

is keen to point out) is context-dependent. In a go-to-market strategy, positioning is entirely dependent on which segment of the market you really go after.Going after the workstation marketplace = “easier to use workstation”

Going after the PC marketplace = “more powerful PC”

But he actually goes a step further.

He segments the market again.

The workstation market, he says, is actually two markets – the more traditional half of science and engineering and a new segment he calls "the professional half.”

Inside this marketplace there are several submarkets: publishing, the high-end publishing houses, medical, a lot of database-driven applications, higher education, etc. etc. etc.

And then he re-analyzes the segment by showing that Sun had an 80% market share of this half of the market with 40,000 units sold.

Now, the positioning becomes very clear. NeXT is the best option for this niche of professionals who want the power of the workstations but the ease of use of a PC.

5. Sizing Up the Opportunity and Ability to Meet It

But is the niche worth pursuing? Every market segmentation exercise has to match up the growth potential of the market with the potential profitability of the company.

He shows not only is the market projected to grow – from 50,000 units in 1990 to 100,000 units in 1991 – but matches it up to NeXT’s ability to produce computers. Their current production capacity was 50,000 units, so if they were able to deliver all of the units they could create, they would earn a 50% market share.

This kind of thinking is less clear in SaaS. The marginal cost of adding an additional user is very low in a software company, so many companies don’t analyze their supply capacity except in extraordinary moments – for example, onboarding a massive enterprise client who might pose constraints on the server infrastructure.

The first exercise (sizing up the market segment and understanding the market share opportunity) is very valuable no matter the company. I’m less positive the second exercise (understanding supply capacity) is required for a standard SaaS company.

6. Market Shifts in Two Segments

He then goes further: what is driving that growth? Why will there be more demand in the professional half of the market?

He focuses on two market shifts:

PCs and Mac owners deciding they want more sophisticated networking, more sophisticated development environments, deciding they need to step up to workstations.

And the real juicy one:

A lot of people now using 3270 terminals or terminal emulators hooked up to a mainframe for database-driven applications. More and more, they are deciding to move their applications on to a powerful desktop workstation connected via networking to the mainframe, so that they can get the application out of the mainframe and on to the desktop for more rapid development, for better user interface, and for better economics.

What Steve is doing here is a very quick, off-the-cuff summary of a value proposition in the Robert Kaminski style. He’s tying use cases and problems to capabilities and benefits.

These mainframe users are trying to build database-driven applications (the use case), but in the current mainframe set-up, he implies it is slow to develop (the problem). So the NeXT workstation’s primary features of a user-friendly desktop environment and networking are used so they can build applications faster (the benefit).

But he’s also tying these changes back to the overall market shift and what will be driving demand. This way, you have a full picture of the market segment, the growth opportunity, and the value proposition.

More than anything else in the video, this is the critical activity more companies need to do. Market research firms might show you the shifts and can outline data points of potential customers, but they leave it to a GTM team to figure out the value proposition.

In companies without a product marketer, figuring out the value message is usually left to the sales team. There is a lot of throwing-spaghetti-at-the-customer. Unfortunately, product marketers are no salvation. Many deliverables (speaking from experience) are too focused on messaging so they only deliver the value messaging without any context of the market shift.

The market shift is the reason why the buyer is willing to change! In a competitive environment, whether you’re competing against direct competitors or the status quo, that nugget is the key insight that will catapult a campaign into an overnight success.

7. Win/Loss Analysis from 15 Deals

A little bit later, Steve points out that in the new positioning framework (an easier to use workstation for the professional market segment), they will compete head-to-head with Sun. Sun already has 80% market share and will be keen to preserve it.

So is it worth it? Do they have traction?

He states that they reviewed the data and found they had won 15 of the last 15 deals in this market segment in a head-to-head against Sun.

That’s good! That’s really good!

Even though ~80% of B2B software companies do win/loss analysis today (which is a marked improvement from a decade ago), much of the internal use for that data is used in battlecards or other sales enablement materials. Which, like, okay! Good! Your sellers need that insight.

But it’s less clear if it’s being used during market segmentation and targeting decisions. It’s usually a coin flip in the clients I’ve worked with: some do, some don’t. Steve is connecting the win/loss analysis to the market segment to show it’s a worthwhile segment to pursue.

8. Uncovering Demand Drivers

The next big chunk of the video is Steve detailing three primary use cases for a professional workstation. He calls out:

Custom applications

Use great productivity apps

Interpersonal computing (IPC)

What’s interesting about this section is he is very thoughtful about which of these demand drivers are true today vs. true in the future. He’s thoughtfully mapping market trends over the next 24 months and indicating when those trends will matter.

Custom applications are the demand of today: people want to write their own code in a very fast development environment and connect (with NeXT’s advanced networking features) to mainframe databases.

But “using great productivity apps” like Lotus (a predecessor to Excel) isn’t a demand driver for the sale today. It will be in the next 6-12 months. And, it is a driver for upsells into organizations. He even details a case study with a bank that had a small first sale for custom applications, but a much larger upsell that had everything to do with using great productivity apps.

And interpersonal computing (IPC) is a predecessor to internet-networked devices: the idea you could connect a bunch of personal computers together for group collaboration. He’s very explicit that this is a driver over the next 24 months and will require a great deal of customer education, but it is something they should be aware of.

I love this kind of detailed analysis. What he’s showing is that the GTM strategy isn’t just an internal plan to run ads or prioritize different accounts. He’s showing how the company is meeting current demand and anticipating future demand. That’s the power of a great GTM strategy.

9. Product Strategy as a Function of GTM Strategy

He discusses this while detailing the use cases, but also focuses on it when discussing key competitive differentiators: how the NeXT product will lead to more sales.

On one hand, when talking about taking advantage of the great productivity apps, he says:

To the extent that we have even better productivity apps that are better than on PCs, and to the extent that those productivity apps use the network so they can tie people together, we’re gonna win.

“To the extent” is all about the product roadmap – detailing how the investments in great native productivity apps (like an advanced version of Adobe Illustrator) will help them continue to win deals for this use case.

Throughout the video, he’s also interweaving the product differentiators and the product roadmap as key components of the go-to-market strategy. Instead of just competing on the merits of the product as it is today, he’s mapping out the GTM strategy for the next 24 months. And that’s not just how sales & marketing is going to run ads or educate customers! It’s also about product.

10. Specific Tactics to Implement

Interestingly, the video does not detail a specific marketing plan or sales plan. But he does highlight a few specific tactics:

Increasing brand awareness of NeXT to the professional market segment as they enter the market (since they win in head-to-heads with Sun)

Bringing more technical people to their software camps because the key technical people who get hands-on experience with the NeXT development environment rave about it when they return home

Bringing a demo reel to customer visits to highlight the benefits of interpersonal computing

These are three very specific and important tactics to take – strategic levers that you could bet a lot of money on given what they already know.

What’s most fascinating to me is Steve doesn’t even mention a marketing plan until he’s 14 minutes in of a 19 minute video. This GTM strategy is all about answering the three questions he posed at the beginning: who they serve, why they win, and how they’ll reach those customers.

The specific tactics to take become so obvious from the answers he provides to the first two questions.

If they win in head-to-heads so often due to their development environment… the tactics become obvious

If the professional market is growing because PC users want more power… the tactics become obvious

If the professional market is growing because workstation users want to develop on a desktop instead of the mainframe… the tactics become obvious

All of the “downstream” decisions about what kinds of ads, messaging, sales collateral, talk tracks, and so on become obvious because the market has been so clearly defined and understood. This is how really great market analysis leads to a perfect GTM strategy.

Okay, now the punchline: famously, this strategy flopped. NeXT only sold 50,000 units in total and they shut down the entire hardware segment two year later (in 1993) to focus on software. It ended up still being a highly influential company. Tim Berners-Lee used a NeXT computer to develop the first web browser and web server. And the software went on to be the underpinning for Mac OS X.

So why is this a perfect GTM strategy if it flopped? Because it has all of the component parts any company needs to succeed. No business leader has a perfect eye for strategy, every time. Steve, of course, had a few home runs in his career. NeXT wasn’t it. Many attribute the failure of the hardware to its price (it was very expensive) which is a related but distinct element of the GTM process.

But, I’m also confident he was using the same exact process when he launched the iPod, iMac, iPhone, and iPad. Maybe you can too.

Watch the video in full below. It really is worth a watch.